Who is online?

In total there is 1 user online :: 0 Registered, 0 Hidden and 1 Guest None

Most users ever online was 92 on Mon Sep 23, 2024 6:45 am

Latest topics

Statistics

We have 352 registered usersThe newest registered user is molifar

Our users have posted a total of 570 messages in 139 subjects

Search

ICT industry

3 posters

Page 1 of 1

ICT industry

ICT industry

My company issued invoice to a customer on 27/3 for a website & mobile apps (games).

The problem is the customer wants to pay monthly installments till Dec 2015.

Is that acceptable for us not to charge GST effective on 1st April?

Regards.

The problem is the customer wants to pay monthly installments till Dec 2015.

Is that acceptable for us not to charge GST effective on 1st April?

Regards.

gracyzxx- Posts : 7

Join date : 2015-04-02

Re: ICT industry

Re: ICT industry

If the apps has been delivered and invoiced before 01/04/15, then no GST is chargeable, even if payment is received after 01/04/15.

joseph- Posts : 277

Join date : 2014-09-25

Re: ICT industry

Re: ICT industry

The apps is still in the making- it's the first phase of a project.

It will be completed in 5- 6 months.

The customer wants to avoid GST so, we invoice in full.

Is that acceptable?

Regards.

It will be completed in 5- 6 months.

The customer wants to avoid GST so, we invoice in full.

Is that acceptable?

Regards.

gracyzxx- Posts : 7

Join date : 2015-04-02

Re: ICT industry

Re: ICT industry

Section 183(2) (Transitional Provisions) of the GST Act 2014: where any payment is made or invoice is issued for a supply of goods or services that will be made on or after the effective date (01/04/15), GST is applicable and has to be account for on an inclusive basis in the first taxable period.

This is an anti-avoidance provision - to prevent people from trying to avoid paying tax.

Penalty is a fine not exceeding RM30,000 or imprisonment not exceeding 2 years or both.

This is an anti-avoidance provision - to prevent people from trying to avoid paying tax.

Penalty is a fine not exceeding RM30,000 or imprisonment not exceeding 2 years or both.

joseph- Posts : 277

Join date : 2014-09-25

Re: ICT industry

Re: ICT industry

If sales tax or service tax has been collected, then no need to account for GST.

joseph- Posts : 277

Join date : 2014-09-25

Re: ICT industry

Re: ICT industry

Thank you for the reply, Joseph.

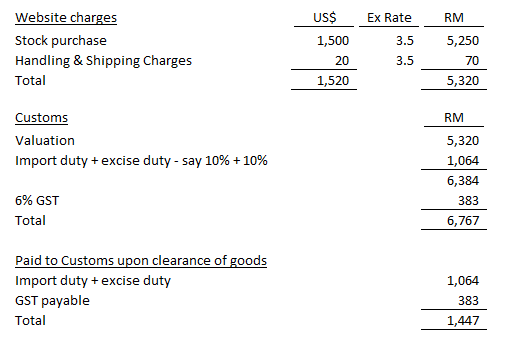

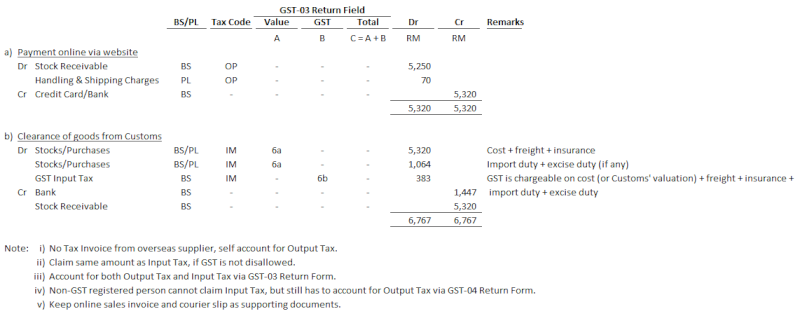

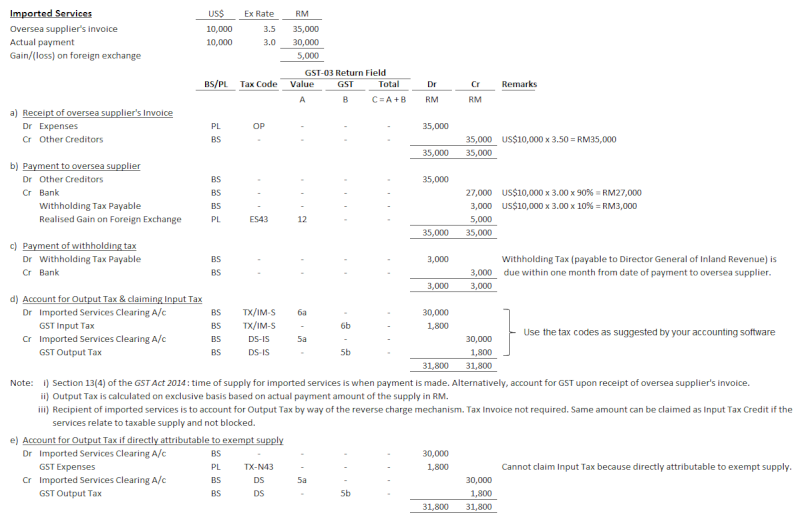

Another thing, we purchases services from overseas by credit card for business purpose.

What tax code to use and how to account reverse charge mechanism?

Pls advise.

Regards.

Another thing, we purchases services from overseas by credit card for business purpose.

What tax code to use and how to account reverse charge mechanism?

Pls advise.

Regards.

gracyzxx- Posts : 7

Join date : 2015-04-02

joseph- Posts : 277

Join date : 2014-09-25

Re: ICT industry

Re: ICT industry

Sorry, you don't account for GST Output Tax because GST has to be paid directly to Customs upon clearance of the goods, as reflected in the above accounting entries.

joseph- Posts : 277

Join date : 2014-09-25

Re: ICT industry

Re: ICT industry

Is it included services too, even where there's no customs (import, excise duty) involved?

Something like buy games apps from Apple or Dropbox/Email service..

For eg,

A purchases online services USD10 (RM35) monthly from overseas for IT business purpose. There is no physical goods/stocks or customs involved.

A accounts: DR purchases RM35

DR Input tax 6% RM2.10

CR Bank RM35

CR Input tax 6% RM2.10 (contra input tax??)

I'm confused as the customs guidelines says we have to pay GST on overseas purchases.

Do we have to report GST, self include GST in this purchases?

Something like buy games apps from Apple or Dropbox/Email service..

For eg,

A purchases online services USD10 (RM35) monthly from overseas for IT business purpose. There is no physical goods/stocks or customs involved.

A accounts: DR purchases RM35

DR Input tax 6% RM2.10

CR Bank RM35

CR Input tax 6% RM2.10 (contra input tax??)

I'm confused as the customs guidelines says we have to pay GST on overseas purchases.

Do we have to report GST, self include GST in this purchases?

gracyzxx- Posts : 7

Join date : 2015-04-02

Re: ICT industry

Re: ICT industry

Hi Joseph,

Referring to the above post, your treatment sounds like there's no GST involved.

It's basically recording it as output tax and then input tax- contra with each other.

Grace

Referring to the above post, your treatment sounds like there's no GST involved.

It's basically recording it as output tax and then input tax- contra with each other.

Grace

gracium- Posts : 4

Join date : 2015-04-20

Re: ICT industry

Re: ICT industry

Yes, that's how reverse charge mechanism works.

If you are GST-registered and the imported service is attributable to taxable supply, then net GST effect is zero.

If you are not GST-registered or the imported service is attributable to exempt supply, then you account for output tax, but cannot claim input tax.

If you are GST-registered and the imported service is attributable to taxable supply, then net GST effect is zero.

If you are not GST-registered or the imported service is attributable to exempt supply, then you account for output tax, but cannot claim input tax.

joseph- Posts : 277

Join date : 2014-09-25

Re: ICT industry

Re: ICT industry

Thanks, Joseph.

Wish to check with you on this:

An employee paid overseas purchases by credit card on 26/4 and by the end of month, the company pays back to the employee on 5/5.

Which date triggers the time of supply?

Wish to check with you on this:

An employee paid overseas purchases by credit card on 26/4 and by the end of month, the company pays back to the employee on 5/5.

Which date triggers the time of supply?

gracium- Posts : 4

Join date : 2015-04-20

Re: ICT industry

Re: ICT industry

Time of supply is when Customs charge you GST & customs duty on your oversea purchases.

joseph- Posts : 277

Join date : 2014-09-25

Re: ICT industry

Re: ICT industry

joseph wrote:Yes, that's how reverse charge mechanism works.

If you are GST-registered and the imported service is attributable to taxable supply, then net GST effect is zero.

If you are not GST-registered or the imported service is attributable to exempt supply, then you account for output tax, but cannot claim input tax.

Joseph, can I account the imported services as N-T/ OP since the net GST effect is zero? I find it a bit redundant.

Regards, Grace

gracium- Posts : 4

Join date : 2015-04-20

Re: ICT industry

Re: ICT industry

No, you have to account for output tax and claim input tax separately.

joseph- Posts : 277

Join date : 2014-09-25

Re: ICT industry

Re: ICT industry

So, I have to create a new account for IMPORTED SERVICES and do the general journal entries.

Can I sum it all in one month because my services costs between RM10 - RM800 per month?

These purchases are made by credit card & don't involve tax invoice.

Can I use credit card statement as a proof?

Can I sum it all in one month because my services costs between RM10 - RM800 per month?

These purchases are made by credit card & don't involve tax invoice.

Can I use credit card statement as a proof?

gracium- Posts : 4

Join date : 2015-04-20

Similar topics

Similar topics» GST @ Hotel Industry

» Additional industry code

» Links to Royal Malaysian Customs Industry GST Guides - Incomplete, in progress

» Additional industry code

» Links to Royal Malaysian Customs Industry GST Guides - Incomplete, in progress

Page 1 of 1

Permissions in this forum:

You cannot reply to topics in this forum

» Industrial Diesel

» ICT industry

» Input Tax (Passenger Car for business purpose)

» Conditions to Claim Input Tax

» Additional industry code

» Sales Commisions

» Advance payment for services not rendered yet

» Turnover Below RM500,000 subequent to GST registration

» Consigment Sales

» GST Accounting Entries

» Advance payment received from Customer