Who is online?

In total there are 3 users online :: 0 Registered, 0 Hidden and 3 Guests None

Most users ever online was 44 on Wed Dec 06, 2023 3:30 am

Latest topics

Statistics

We have 352 registered usersThe newest registered user is molifar

Our users have posted a total of 570 messages in 139 subjects

Search

Discontinuing my support

3 posters

Page 1 of 1

Discontinuing my support

Discontinuing my support

This is my last posting. Regrettably, I will stop supporting this forum with immediate effect.

I have prepared a list of 63 common GST accounting entries, complete with examples, tax codes and where applicable references to the GST Act, Regulations, Orders, DG's Panel Decisions and/or GST Guides.

I have also prepared a list of common supplies and purchases/acquisitions and their corresponding recommended tax codes.

For mixed suppliers, I have created a CGA computation worksheet.

All the 3 files are in Excel format.

I have invested much time and effort on this GST project, attended many training and seminars, made numerous phone calls and met up with senior Customs officials and obtained feedback from prominent GST Tax Consultants to prepare the files.

While I do not guarantee that they are in complete compliance with Customs requirements, I am confident they are reasonably well prepared and in accordance with the laws.

If you are interest to have them, I am charging RM500 for the 3 files.

If you purchase the files, I will continue to support you via e-mails, for a period of 3 months.

Please e-mail me at josephteh@hotmail.com if you are interested.

Thank you all for your participation in this forum.

Signing off for the last time.

Best regards

Joseph Teh

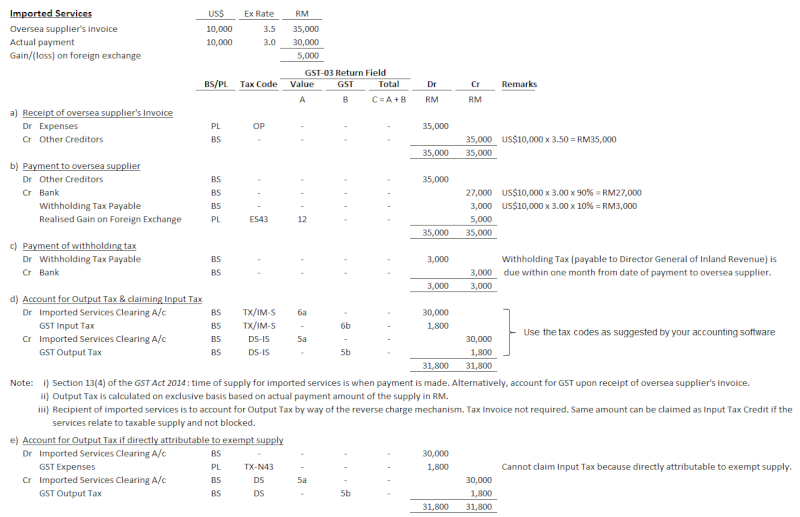

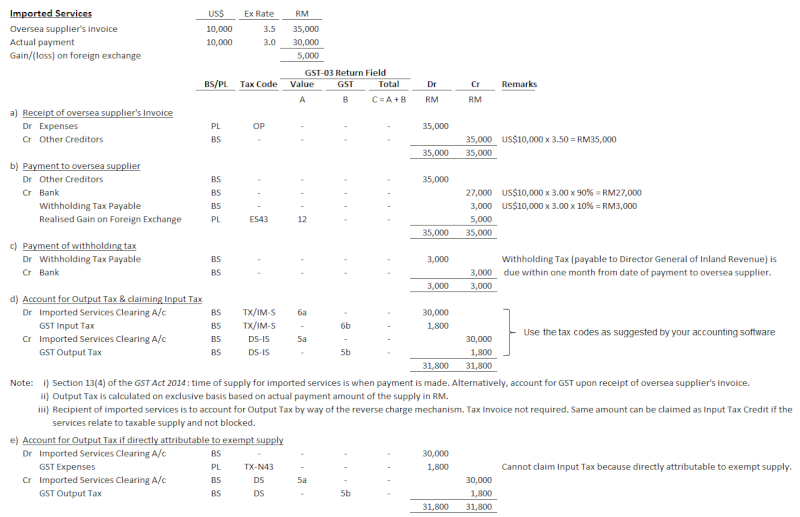

List of common GST accounting entries:

Example:

I have prepared a list of 63 common GST accounting entries, complete with examples, tax codes and where applicable references to the GST Act, Regulations, Orders, DG's Panel Decisions and/or GST Guides.

I have also prepared a list of common supplies and purchases/acquisitions and their corresponding recommended tax codes.

For mixed suppliers, I have created a CGA computation worksheet.

All the 3 files are in Excel format.

I have invested much time and effort on this GST project, attended many training and seminars, made numerous phone calls and met up with senior Customs officials and obtained feedback from prominent GST Tax Consultants to prepare the files.

While I do not guarantee that they are in complete compliance with Customs requirements, I am confident they are reasonably well prepared and in accordance with the laws.

If you are interest to have them, I am charging RM500 for the 3 files.

If you purchase the files, I will continue to support you via e-mails, for a period of 3 months.

Please e-mail me at josephteh@hotmail.com if you are interested.

Thank you all for your participation in this forum.

Signing off for the last time.

Best regards

Joseph Teh

List of common GST accounting entries:

- Recording Sales Transactions (Standard-Rated Supply)

- Tax Invoice Issued Late (after 21 days from Basic Tax Point)

- Advance Payment received from Customer (without issuing customer Tax Invoice)

- Bad Debt Relief & Recovery (1)

- Bad Debt Relief & Recovery (2)

- Local Zero-Rated Supplies

- Export Zero-Rated Supplies (Customs K2 Form required)

- Incidental Exempt Supply (Financial Services)

- (Non-Incidental) Exempt Supply

- Sale of goods or services where invoice issued or payment received before effective date, but delivery only after effective date (Transitional Issue)

- Disposal of Capital Goods

- Disposal of Manufacturing Waste

- Unexplained Stock Quantity Loss

- Non-business or Private Use of Business Assets

- Reimbursement of Expenses

- Disbursement of Expenses

- Recording Purchase Transactions (Standard-Rated Purchase)

- Online Purchase of Stocks from Overseas

- Supplier Invoices Remaining Unpaid for > 6 Months

- Purchase of Capital Goods (Fixed Assets) - Input Tax Not Blocked

- Purchase of Capital Goods (Fixed Assets) - Input Tax Blocked

- Company Cars

- Advance Payment to Supplier (no Tax Invoice)

- Refundable Deposit (not for contra against payments)

- Retention Sum

- Out-of-Scope Supply

- Consideration Paid for neither A Supply of Goods nor Supply of Services

- Independent Director Who Is Not An Employee

- Gifts of Goods (Gift Rule)

- Gifts of Services

- Purchases from Non GST-Registered Suppliers

- Purchase/Acquisition of Exempt Items

- Loan Received & Interest Payable (Exempt Supply)

- Purchases of Zero-rated Items

- Staff Claims

- Imported Goods

- Imported Services

- Rental Income from Commercial Properties

- Rights Granted for Life (or for a period ≥ 30 years) by Club or Other Similar Body

- Rights Granted for a period < 30 years by Club or Other Similar Body

- Hire Purchase Transactions

- Residual Input Tax Claim (for mixed supplier)

- Capital Goods Adjustments (CGA) (for mixed supplier)

- Transactions between GST-Registered Group Companies

- Monetary Vouchers

- Non-Monetary Vouchers

- Sale of Monetary Vouchers by Third Parties on Commission Basis

- Sale of Non-Monetary Vouchers by Third Parties on Commission Basis

- Unredeemed Unexpired Non-Monetary Vouchers @ 01/04/15 (Transitional Issue)

- Loyalty Points (for Program Operator)

- Loyalty Points (for Program Operator & Redemption Partner, both same person)

- Expiry of Unredeemed Loyalty Points (for Program Operator)

- Loyalty Points (for Merchants - Program Partner & Redemption Partner)

- Vending Machine Sales

- Consignment Sales (for Consignor)

- Sales of Goods by Agents (for Principal)

- Sales of Prepaid Reload Phone Cards by MOL's Merchant

- Sales of Prepaid Reload Phone Cards by MOL

- Payment of GST

- Special Sales Tax Refund for Goods Held On Hand

- Imported Goods under Approved Trader Scheme (ATS)

- Staff Usage over Limits

- Fines & Penalties

Example:

joseph- Posts : 277

Join date : 2014-09-25

Re: Discontinuing my support

Re: Discontinuing my support

A few wrote to me to say my charges of RM500 too expensive.

For a limited time only, RM300 for the 3 Excel files + 3 months e-mail support in answering your queries.

joseph- Posts : 277

Join date : 2014-09-25

Re: Discontinuing my support

Re: Discontinuing my support

Wow.. the GST Accounting Entries and Tax Code Mapping files are so comprehensive. Better than any of the seminars I have attended. Worth the money! Thanks Joseph for making available the files.

leekk- Posts : 1

Join date : 2015-01-31

Re: Discontinuing my support

Re: Discontinuing my support

Added one more GST Accounting Entry:

64. For non GST-registered Companies using GST-compliant Accounting Software

64. For non GST-registered Companies using GST-compliant Accounting Software

joseph- Posts : 277

Join date : 2014-09-25

Re: Discontinuing my support

Re: Discontinuing my support

The RM300 GST Package is for your specific business purpose only. Not for use to help your clients.

Any GST queries should strictly refers specifically to your business and the industry your business is in.

If you are a GST Tax Consultant, the package is not meant for you.

I will continue to support general queries on this forum during my spare time.

If you want to know about how to record GST transactions and/or what tax codes to use, please sign up for the RM300 package.

Any GST queries should strictly refers specifically to your business and the industry your business is in.

If you are a GST Tax Consultant, the package is not meant for you.

I will continue to support general queries on this forum during my spare time.

If you want to know about how to record GST transactions and/or what tax codes to use, please sign up for the RM300 package.

joseph- Posts : 277

Join date : 2014-09-25

Re: Discontinuing my support

Re: Discontinuing my support

We would like to engage you as a GST Consultant for our company. Would you be interested?

penangmali- Posts : 1

Join date : 2014-09-27

Re: Discontinuing my support

Re: Discontinuing my support

No, thanks. Appreciate your offer. I have a full time job.

joseph- Posts : 277

Join date : 2014-09-25

Page 1 of 1

Permissions in this forum:

You cannot reply to topics in this forum|

|

|

» Industrial Diesel

» ICT industry

» Input Tax (Passenger Car for business purpose)

» Conditions to Claim Input Tax

» Additional industry code

» Sales Commisions

» Advance payment for services not rendered yet

» Turnover Below RM500,000 subequent to GST registration

» Consigment Sales

» GST Accounting Entries

» Advance payment received from Customer